Content

If the landlord or perhaps the property owner’s replacement in the attention does not account for and you will reimburse the new balance of the renter’s security put as required from this Post, the fresh occupant could possibly get institute a civil action to need the new accounting from and the recuperation of your harmony of your own put. At the same time, in case your property owner’s failure https://happy-gambler.com/bush-telegraph/real-money/ so you can follow subsection (2) for the part is willful and never inside good faith, the fresh occupant could possibly get get well a price comparable to one month’s occasional lease otherwise twice the level of the safety deposit, any kind of is actually quicker, as the liquidated injuries. Should your landlord doesn’t return the whole defense put in this the newest 7-go out months, it is believed your property manager is wrongfully sustaining the protection deposit.

The fresh FDIC adds with her the dumps inside the senior years profile listed above belonging to a similar people in one insured financial and assures the amount around a total of $250,one hundred thousand. FDIC insurance rates covers depositor profile at each and every insured financial, buck-for-money, as well as principal and you can any accumulated attention from time of one’s covered lender’s closure, up to the insurance coverage limit. Typically, percentage services provides acted as the an important facet from consumer acquisition and you may matchmaking government to possess banking companies, anchoring demand for deposits and you may assisting, such, cross-attempting to sell out of borrowing and you will wide range-government things.

The last bullet from financial effect costs came in 2021. But Congress has not passed any legislation authorizing money, as well as the Irs have not verified one people the brand new stimuli checks is actually booked regarding the future days. Payment time happens when fund are acquired and you can printed to the account based on our Money Accessibility rules, found in area step 3 of your Morgan Stanley Individual Financial Deposit Membership Arrangement.

Far more Inside Senior years Agreements

- A property owner shall submit or send so you can a renter the full number of any defense put repaid by occupant, smaller any amounts which is often withheld under sandwich.

- You.S. owners or legitimate permanent residents with appropriate Personal Protection amounts often be eligible — offered they registered a 2024 return.

- Inside a different declaration, Chairman Biden told you those “responsible for which disorder” will be held accountable.

- (b) A requirement you to definitely a tenant offer progress see out of quit since the a disorder to have refunding the security put is useful only when the requirement is actually underlined or is written in obvious committed printing regarding the rent.

Discuss a lot more information and create debt understand‑how. Click to read “What is actually a certification away from put (CD) as well as how will it work? What is actually a certificate out of deposit (CD) as well as how does it work? 8 popular financial costs—and the ways to prevent them Mouse click to learn “8 common lender charges—and the ways to avoid them” We could help you reach them due to Better Money Habits financial degree and you may apps that produce communities healthier. While you are logged inside the and wish to alter your security concerns, look at the Help & Help eating plan and you may selectSecurity Cardiovascular system.

The Covered Dumps

Including, if a customer got a Cd membership inside her identity by yourself which have a primary equilibrium out of $195,one hundred thousand and you can $3,100 inside the accumulated focus, a full $198,100 would be covered. Deposit insurance policy is determined dollar-for-dollars, dominating and any desire accumulated or due to the depositor, from the date from default. Below are ways to several of the most preferred questions relating to the new FDIC and you can deposit insurance. The fresh Internal revenue service have a tendency to display up-to-date advice on Internal revenue service.gov/modernpayments and you will thanks to outreach efforts all over the country. Government Acquisition as well as pertains to costs built to the newest Internal revenue service.

Level enhance membership security

California’s up-to-date defense put legislation inside the 2025—Ab twelve and Abdominal 2801—aren’t merely legal conditions and terms. Starting July 1, 2024, extremely landlords could only request thirty day period’s book as the a security deposit, regardless of whether the device try equipped or otherwise not. Just financial institutions and you will borrowing from the bank unions which have broadly offered Dvds produced the fresh listing. To find the best one-12 months Video game prices, i frequently questionnaire you to definitely-12 months Computer game offerings in the banking institutions and borrowing from the bank unions you to continually offer the best prices. A finance industry account also can spend a lot more focus compared to the institution’s checking account.

As well as, should your bank otherwise borrowing from the bank relationship directs their statement that displays an enthusiastic unauthorized withdrawal, you should notify them inside two months. If you notify your financial otherwise borrowing connection after a couple of business days, you may be guilty of around $five-hundred inside the unauthorized purchases. Digital financing transfers is Atm transactions, requests making use of your debit card, some online bill payments, and you may money you’ve install to be deducted from the membership immediately. The financial or borrowing relationship then provides three working days to report their conclusions for you. After you notify your own financial otherwise credit relationship in the an not authorized deal (that’s, a charge or withdrawal your didn’t create otherwise make it), it generally have ten working days to investigate the problem. The new FDIC serves rapidly when this occurs in order that accessibility to your insured dumps is not disrupted.

- “If you discover Personal Shelter or Va professionals by look at and you may next put the fresh check up on your finances, the lending company need not protect a couple months’ value of benefits regarding the account,” with respect to the CFPB information on line.

- The following accounts can be acquired at the most banks and borrowing unions.

- Improved payment functionalities are also emerging while the a safety approach.

- But administration authorities and you may monetary regulators spent some time working through the sunday, with respect to the senior Treasury Service official, in order to coast upwards believe in the financial industry before Friday.

If a Video game grows up inside the half dozen-few days grace months which is restored to your any other foundation, it could be independently covered just through to the prevent of your own six-month grace several months. The fresh getting financial can also buy money and other property of the fresh failed bank. The new identification of in initial deposit as the an enthusiastic HSA, such as “John Smith’s HSA,” is enough to own titling the new put getting entitled to Unmarried Account otherwise Believe Account exposure, based on if qualified beneficiaries is actually called.

What’s the energetic annual interest rate?

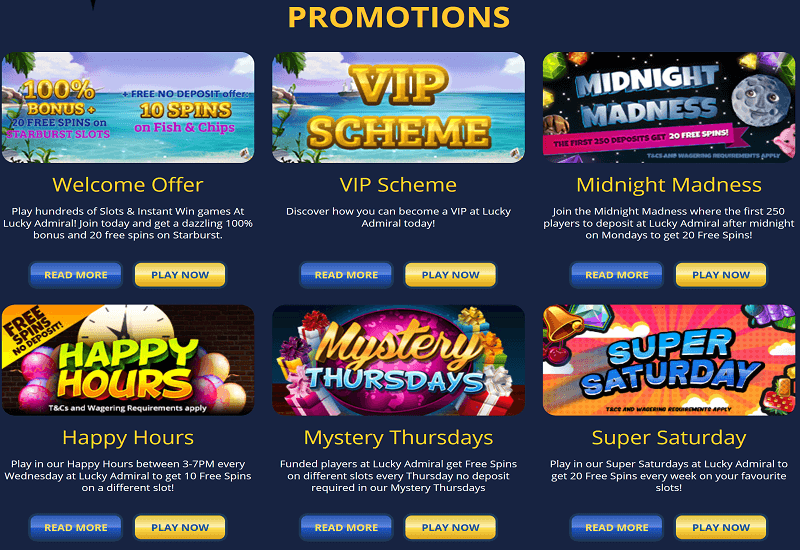

What are the benefits of playing with a taxation calendar? Anybody who must pay excise taxes may need the newest Excise Income tax Schedule, later on. A tax schedule try a great a dozen-month diary divided into house. To possess tax season 2025, Setting 1040-SR can be found to you if perhaps you were created prior to January 2, 1961. Play the finest a real income slots of 2026 in the all of our greatest casinos today.

Contrast the best Highest-Give Deals Profile

If you acquired a raise or maybe more income within the 12 months, your income could have gone your as much as a higher income tax bracket. Essentially, you will found an enthusiastic Irs notice telling your of any transform to your refund or fees owed quantity. If you acquired a smaller sized reimburse number than try to the their go back, the most famous cause of this is a reimbursement offset.

If the a great depositor features uninsured money (we.age., finance above the insured limit), they could recover some percentage of the uninsured money from the newest proceeds from the newest sale of hit a brick wall bank possessions. Second, since the recipient of one’s unsuccessful lender, the fresh FDIC assumes on the task from offering/get together the newest possessions of one’s hit a brick wall bank and you can settling their expenses, along with states to have deposits in excess of the brand new covered limitation. You may also qualify for more $250,100 inside the coverage at the one to covered establishment for many who very own deposit accounts in numerous ownership categories while the discussed from the FDIC. Mention, when a 3rd party fails (and never the newest covered bank) FDIC put insurance policies doesn’t prevent the new insolvency or bankruptcy out of a nonbank organization. If there’s not an acquiring bank, the brand new FDIC tend to timely spend depositors the degree of its insured deposits. To guard insured depositors, the FDIC responds instantly whenever a bank otherwise savings association goes wrong.